Important Links

Click HERE to file your Individual Tax Return online!

Click HERE to file your Employer Tax Return online!

Click HERE to file your Individual Quarterly Estimated Payments Online!

Individuals

Taxpayer Annual Local Earned Income Tax Return

Obtain a Social Security Earnings Record

Pay Taxes by Credit Card or Electronic Check

Notice to New Residents (see in Espanol)

Employers

York City Admissions/Amusement Tax

City of York Act 205 EIT Rate Increase

The Transparency in Coverage Rule

About York Adams Tax Bureau

The York Adams Tax Bureau collects and distributes earned income tax for 124 municipalities and school districts in York and Adams Counties. All residents of Adams County and all residents of York County (except West Shore School District) file their annual earned income tax returns with YATB. The Bureau also collects Local Services Tax, Delinquent Per Capita Tax and Mercantile/Business Privilege Tax for some of its members.

Read More »

Individual & Employer Tax Filing Due Dates

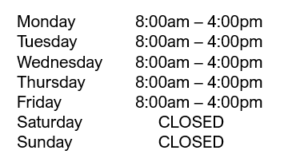

Office Hours

Both offices will be closed on the following holidays:

- New Year’s Day

- Presidents’ Day

- Memorial Day

- Independence Day

- Labor Day

- Thanksgiving Day (including Black Friday)

- Christmas Eve

- Christmas Day

- New Year’s Eve